When interested parties decide to work together on R&D, they usually form a limited partnership. The limited partners provide funding, while the general partner manages the day-to-day activities and technical aspects under contract to the limited partnership—generally at cost-plus-margin, or for a fixed fee. For example, costs in relation to the general partner are typically recorded as services delivered during the period of the project, while limited partners record their investment as R&D expenses.

The second category is equipment that can eventually be used

for some other purpose besides research. This equipment should be capitalized

as an asset and depreciated over its useful life. While being used for research

purposes, research and development expense should be debited. Once it is put

into general service, depreciation expense should be debited. Under the 2017 Tax Cuts and Jobs Act (TCJA), the tax treatment of research and development (R&D) expenses have changed.

Advantages Of R&D Cost

This documentation must support, to the satisfaction of the exam team, that the amounts reported on Appendices C & D are true, correct and complete. The basic accounting rules require organizations to expense their Research and development expenditure in the period… As a general rule of thumb, the more technical the industry’s products/services are, the more outsized R&D spending will be. Considering how long-term the expected economic benefits could be, one could make the case that all R&D should instead be capitalized rather than treated as an expense. The Research and Development (R&D) expense refers to spending related to funding internal initiatives around introducing new products or further developing their existing offerings. A company that focuses on development and buys in research can treat the cost of that research as expenses, together with the cost of any activity needed to make it into a commercial concern.

When a company spends money on R&D, whether through purchased services or through its own R&D department, it must record the cost as an expense in the period incurred, reports the Corporate Finance Institute. This includes the cost of materials, equipment and facilities that have no alternative futures – that is, items that the company doesn’t use for other purposes. For example, if you estimate an R&D product will provide economic benefits for seven years, you will need to amortize over this set period. As you can see, it’s becoming increasingly complicated to manage capitalized R&D in a tax-efficient way. Capitalizing R&D is the process a business will use to classify a research and development activity as an asset rather than an expense. Capitalized R&D moves the costs of research and development from the top of the balance sheet to the bottom.

What are Short-Term Assets?

These new R&D laws have been the biggest shakeup of the R&D system in decades. Companies need to prepare for significant changes Accounting for research and development in their balance sheets in 2022 and beyond. The definition of a business is an area of change under both US GAAP and IFRS.

- The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity.

- The FASB’s guidance has been around a long time – the guidance on R&D costs dates back to 1974 and FASB Statement No. 2, while the guidance on R&D funding arrangements dates back to 1982.

- Capitalizing R&D is the process a business will use to classify a research and development activity as an asset rather than an expense.

The rules and regulations that guide organizations about the proper treatment of different financial transactions in their accounting books are known as accounting standards; the accounting boards set the standards. Research and development costs must be capitalized and amortized over 20 years or less. Research and development costs must be capitalized and amortized over 70 years or less. In terms of how research and development expenses are projected in financial models, R&D is typically tied to revenue.

Preparing for R&D Capitalization

The matching principle tells us to expense costs in the same period that those costs provide some benefit to the company. Interpretation of the matching principle gets a bit fuzzy when dealing with research and development. Definition of discovering new ideas is the forgone economic resources by the firm to finance discovering of new products. These endeavors eliminate the business risk of becoming obsolete by meeting the cost of researching on which product ad in diversifying the market.

No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation. The starting point for companies applying IFRS is to differentiate between costs that are related to ‘research’ activities versus those related to ‘development’ activities. While the definition of what constitutes ‘research’ versus ‘development’ is very similar between IFRS and US GAAP, neither provides a bright line on separating the two.

The $0.5 million for patent filing and legal fees would also be capitalized as it adds to the value of the intangible asset. The R&D tax credit provides opportunities for startup businesses to reduce their tax liability and keep cash in their business through the federal payroll tax offset. Of course, depending on the product, there may be a longer or shorter economic life. Since mobile phones tend to emerge and disappear quickly, Company A calculates that they can expect to create a profit from this R&D product for the next three years. When capitalizing, the company will be using a three-year amortization period. For example, let’s say a pharmaceutical company has reported a $10 million figure for revenue and has spent $100 million in drug development in an offshore facility.

However, this method of accounting means that companies (especially in certain industries) often fail to show some of their most valuable assets on their balance sheets. The general problem for companies is that future benefits from research and development are uncertain to be realized, and therefore R&D expenditures cannot be capitalized. Accounting standards require companies to expense all research and development expenditures as incurred.

Repair Vs. Replacement for Tax Deductions

Research and development costs related to retail software (software

for sale) are expensed under different rules. Once a project reaches technological

feasibility, development costs can be capitalized in a manner similar to

inventory production costs. As the software is sold, the capitalized costs are

amortized to expenses. Similarly, costs incurred to develop internal

software are expensed until technological feasibility is reached.

- Under the 2017 Tax Cuts and Jobs Act (TCJA), the tax treatment of research and development (R&D) expenses have changed.

- You may need to reconsider your current accounting methods and pivot to meet the latest rules and regulations in 2022.

- For the purposes of accounting, “research” can be defined as planned activity that sets out to uncover new knowledge, with the aim of significantly improving existing products or processes, or creating new ones.

- In practice, these changes mean your company cannot deduct R&D costs in the fiscal year they were incurred.

With little prospect of the law being repealed, this is the new reality for companies and R&D. Improving business performance, turning risk and compliance into opportunities, developing strategies and enhancing value are at the core of what we do for leading organizations. About the Author – Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya.

The general partner typically reports its current expenses as the cost of services delivered, but the limited partners report their costs as R&D expenses. Reporting research and development costs poses incredibly difficult challenges for accountants. As can be seen with Intel and Bristol-Myers Squibb, such costs are often massive because of the importance of new ideas and products to the future of many organizations. Unfortunately, significant uncertainty is inherent in virtually all such projects. The probability of success can be difficult to determine for years and is open to manipulation for most of that time. Often the only piece of information that is known with certainty is the amount that has been spent.

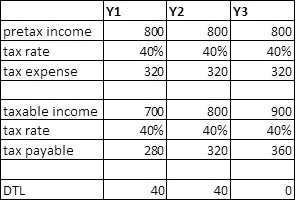

The total cost incurred each period for research and development appears on the income statement as an expense regardless of the chance for success. This example demonstrates how R&D costs can have a different impact on financial statements based on the accounting standards in use. Under U.S. GAAP, the entire R&D outlay impacts the company’s profit and loss in the year the costs are incurred. Under IFRS, a portion of the costs (related to development) can be deferred to future periods through capitalization and subsequent amortization.

PART II. ELIGIBLE QRES IN COMPUTING THE RESEARCH CREDIT

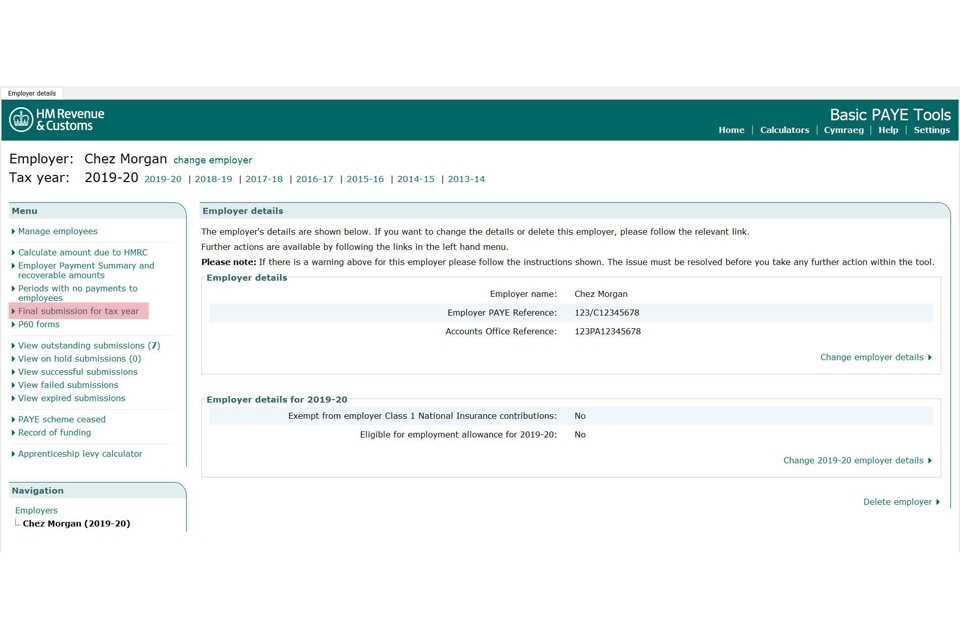

GAAP “solves” the problem by eliminating the need for any judgment by the accountant. This Directive only applies to LB&I taxpayers (i.e. assets equal to or greater than $10,000,000) who follow U.S. In addition, this Directive does not apply to any taxpayer unless the taxpayer uses these same U.S. GAAP financial statements to reconcile book income to federal tax income on Schedule M-3.

N.C. A&T Announces Record $147.4M Year in External Research … – North Carolina A&T

N.C. A&T Announces Record $147.4M Year in External Research ….

Posted: Fri, 18 Aug 2023 14:05:31 GMT [source]

For example, Meta (META), formerly Facebook, invests heavily in the research and development of products such as virtual reality and predictive AI chatbots. These endeavors allow Meta to diversify its business and find new growth opportunities as technology continues to evolve. Research and development costs must be capitalized and expensed each year to the extent that their value has declined. The professional guidelines for recording R&D costs were designed with the accrual accounting method in mind. Companies using the cash basis method of accounting will record expenses arising from R&D when they are paid.

If the company expects to bring in $30 million of

revenue for the program, the amortization under percentage of revenue would be

$100,000. Therefore, the company will amortize $200,000 of the asset to expense

for 20X4. Consequently, any decision maker evaluating a company that invests heavily in research and development needs to recognize that the assets appearing on the balance sheet are incomplete. Such companies spend money to create future benefits that are not being reported. The wisdom of that approach has long been debated but it is the rule under U.S.