Experience the benefits of credit union membership, including low fees, great rates and personalized service. Central to the break-even analysis is the concept of the break-even point (BEP). The following break-even point analysis formulas will help you get there. Break-even (or break even), often abbreviated as B/E in finance is sometimes called point of equilibrium.

- Traders can use break-even analysis to set realistic profit targets, manage risk, and make informed trading decisions.

- Together, fixed and variable costs make up the total costs for a business.

- By knowing the minimum number of units a company needs to sell to cover costs, businesses can set prices that ensure profitability while remaining competitive.

- The break-even point allows a company to know when it, or one of its products, will start to be profitable.

- These costs can be estimated as a percentage of revenue, often ranging from 5% to 10%.

Break-even point via the contribution margin

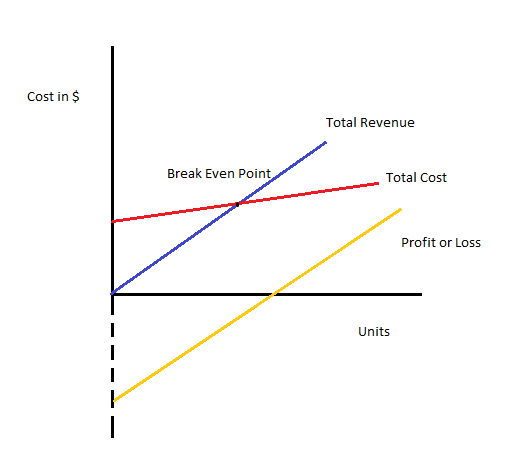

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. It is only useful for determining whether a company is making a profit or not at a given point in time. The break-even point or cost-volume-profit relationship can also be examined using graphs.

How to Conduct Break-Even Analysis

By reducing her variable costs, Maggie would reduce the break-even point and she wouldn’t need to sell so many units to break even. This $40 reflects the revenue collected to cover the remaining fixed costs, which are excluded when figuring the contribution margin. This is a huge, but sometimes overlooked, factor in the solar payback period. Basically, the higher the electricity rates where you live, the more lucrative solar can be for you. As utility rates increase, you save more money by relying on your solar panels instead of drawing power from the grid. Once you know the total cost of your solar system, you also have to factor in any state or federal rebates you might qualify for.

Contoh Studi Kasus BEP

Let’s show a couple of examples of how to calculate the break-even point. Breaking even could become challenging or even impossible without adequate demand or production capability. To understand how to calculate the BEP, it’s essential to realise a few key concepts.

He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

When determining a break-even point based on sales dollars:

In effect, the insights derived from performing break-even analysis enables a company’s management team to set more concrete sales goals since a specific number to target was determined. Businesses share the similar core objective of eventually becoming profitable in order to continue operating. Otherwise, the business will need to wind-down since the current business model is not sustainable. “When will we actually make money?” is the burning question for new businesses. Fortunately, you can answer this question by calculating your break-even point.

The break-even point is the volume of activity at which a company’s total revenue equals the sum of all variable and fixed costs. The break-even point is the point at which there is no profit or loss. Variable costs are the costs that are directly related to the level of production or number of units sold in the market. Variable costs are calculated on a per-unit basis, so if you produce or sell more units, the variable cost will increase. Some common examples of variable costs are commissions on sales, delivery charges, and temporary labor wages. Fixed costs are costs that are incurred by an organization for producing or selling an item and do not depend on the level of production or the number of units sold.

Decide on the selling price for each unit of your product or service. He is considering introducing a new soft drink, called Sam’s Silly Soda. He wants to know what kind of impact this new drink will have on the company’s finances. So, he decides to calculate the break-even point, so that he and his management team can determine whether this new product will be worth the investment. Another critical factor is limiting constraints such as capacity and market demand. The break-even point of Makeup Company X is 250, meaning that the company must sell 250 units of their products to cover the business expenses and not lose money.

In stock and options trading, break-even analysis helps determine the minimum price movements required to cover trading costs and make a profit. Traders can use break-even analysis to set realistic profit targets, manage risk, and make informed trading decisions. The contribution margin represents the revenue required to cover a business’ fixed costs and contribute to its profit. With the contribution margin calculation, a business can determine the break-even point and where it can begin earning a profit. The break-even point can be affected by a number of factors, including changes in fixed and variable costs, price, and sales volume.

Variable costs often fluctuate, and are typically a company’s largest expense. Calculating the break-even point is a financial analysis for businesses that gives you insight on where your company stands financially. lease accounting guide Keep reading to learn everything about this calculation and why it matters, and get the break-even formula. It’s important to study the feasibility of any project or new product line that you’re planning to launch.