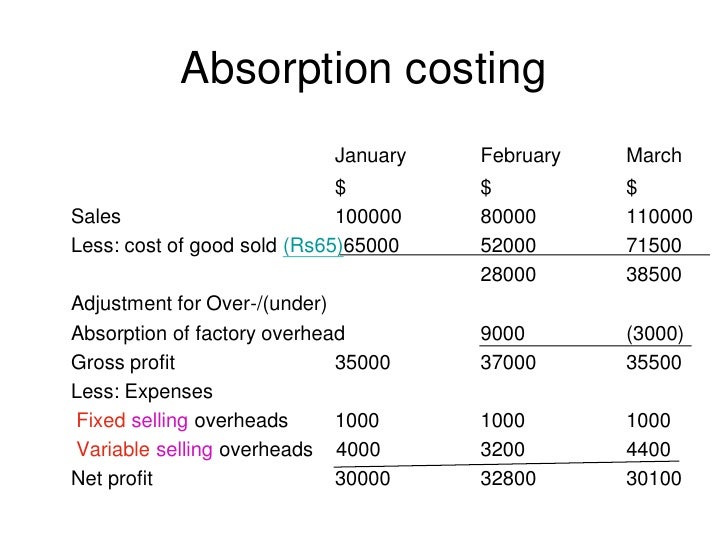

The basic format is to simply show the sales less the cost of goods sold equal gross profit. And also show the gross profit less the selling and administrative expenses and that equals the operating income. To complete periodic assignments of absorption costs to produced goods, a company must assign manufacturing costs and calculate their usage. Since inventory costs are not expensed until sold, the two income statements will give different operating income.

Income Statement Under Absorption Costing: Explanation, Example, And More

These variable manufacturing costs are usually made up of direct materials, variable manufacturing overhead, and direct labor. The product costs (or cost of goods sold) would include direct materials, direct labor and overhead. Under absorption costing, the fixed manufacturing overhead costs are included in the cost of a product as an indirect cost. These costs are not directly traceable to a specific product but are incurred in the process of manufacturing the product. In addition to the fixed manufacturing overhead costs, absorption costing also includes the variable manufacturing costs in the cost of a product.

Key Principles of Absorption Costing

To arrive at the cost of closing inventory, we simply have to multiply the number of units with the absorption cost i-e $8 to arrive at $240,000. Managers can manipulate income by changing the number of units produced Producing more products gives a higher income. Since this method shows lower product costs than the pricing offered in the contract, the order should be accepted.

Calculating Ending Inventory Using Absorption Costing

Under generally accepted accounting principles (GAAP), absorption costing is required for external financial reporting. Absorption costing captures all manufacturing costs, including direct materials, direct labor, and both variable and fixed overhead, in the valuation of inventory. In the manufacturing sector, absorption costing is particularly relevant due to the significant role of fixed costs in production. Manufacturers often incur substantial fixed costs in the form of machinery, plant maintenance, and labor contracts. This can be particularly useful for long-term pricing strategies and inventory management.

It is a very common method used widely in the business especially in the manufacturing sector, and in this way the company is able to determine the cost of individual product and services. Absorption costing is by GAAP because the product cost includes fixed overhead. It is not by GAAP because the fixed overhead is treated as a period cost and is not included in the cost of the product. The difference between variable and absorption costing is that different management prefers to use one method more for decision making than the other. Fixed overhead is not always included in the value inventory of variable costing. The income statement divides the period and product cost to have an overview of the costs.

- This is because variable costing will only include the extra costs of producing the next incremental unit of a product.

- Each unit of a produced good can now carry an assigned total production cost.

- By means of this technique to determine profits, no distinction is made between variable and fixed costs.

- This capitalization results in a lower taxable income in the current period, as the recognition of these costs is postponed until the sale of the inventory.

Net Income Determination in Absorption Costing

However, variable costs applied per unit would be $200 for both the first and the tenth bike. Under the Tax Reform Act of 1986, income statements must use absorption costing to comply with GAAP. Managers use variable costing to determine which products to offer and which products to discontinue. Rather than discontinuing a product based on negligible profits, a manager can use variable costing to determine the overall costs of keeping a unit in production.

Kristin is a Certified Public Accountant with 15 years of experience working with small business owners in all aspects of business building. In 2006, she obtained her MS in Accounting and Taxation and was diagnosed with Hodgkin’s Lymphoma two months later. Instead of focusing on the fear and anger, she started her accounting and consulting firm. In the last 10 years, she has worked with clients all over the country and now sees her diagnosis as an opportunity that opened doors to a fulfilling life.

This is because fixed costs are now being spread thinner across a larger production volume. Under variable costing principles, direct materials, direct labor and variable manufacturing overhead represent the product’s cost. Fixed manufacturing the retirement savings contribution tax credit overhead costs are a part of a company’s period expenses listed on the income statement. Variable costing is not allowable under generally accepted accounting principles as it violates proper accounting procedures for period expenses.

Additionally, it is not helpful for analysis designed to improve operational and financial efficiency or for comparing product lines. In addition, the use of absorption costing generates a situation in which simply manufacturing more items that go unsold by the end of the period will increase net income. Because fixed costs are spread across all units manufactured, the unit fixed cost will decrease as more items are produced.