Small business owners generally adopt the periodic inventory system while building their company. You can reassess your needs as your business grows; you may decide to switch to the perpetual method when the benefits outweigh the costs of installing the three types of accounting and why they matter to your business the system. Try Skynova’s accounting software, and you won’t have to spend time learning how to do your own journaling. The double-entry accounting feature records every transaction, ensuring there’s a complete accounting record for your business.

Point-of-Sale Systems

Then, it performs a detailed physical inventory, reporting back each unit sold by the date the purchase was made. In a perpetual LIFO system, the company also uses the running ledger tally for purchases and sales, but they sell the inventory that they last purchased before moving to older inventory. In other words, the cost of what they sell is the same as what they most recently paid for that inventory.

Different between Periodic and Perpetual

It makes sense when we look at the formula, the beginning balance plus new purchase less ending must result as the sold item. This formula only uses to make assumptions and calculate the quantity of inventory being sold. To calculate the valuation of goods sold, it will be a problem when the cost we spend changes over time.

Perpetual LIFO

This method is most effective for a company with a small amount of inventory due to the labor required to do a physical count of inventory. Companies using periodic inventory procedure make no entries to the Merchandise Inventory account nor do they maintain unit records during the accounting period. Thus, these companies have no up-to-date balance against which to compare the physical inventory count at the end of the period. Inventory management systems impact every element of business operations, from order fulfillment and revenue generation to warehouse and overhead costs.

You just need a team to conduct the physical inventory count and an accounting mechanism to calculate the cost of shutting inventory to deploy a periodic inventory system. The inventory weighted average approach, FIFO (first-in-first-out), and LIFO (last-in-first-out) are all viable computation methods. FIFO means first-in, first-out and refers to the value that businesses assign to stock when the first items they put into inventory are the first ones sold. Products in the ending inventory are the ones the company purchased most recently and at the most recent price.

- The periodic inventory system is an effective method of tracking inventory levels, but there are certain drawbacks that must be taken into consideration.

- It is the temporary account that will be reversed to zero on the reporting date.

- Knowing the exact costs earlier in an accounting cycle can help a company stay on budget and control costs.

- Under periodic inventory procedure, the Merchandise Inventory account is updated periodically after a physical count has been made.

- Ultimately, the decision should be based on the company’s individual needs and budget.

- The periodic examination of inventory is referred to as part of the periodic inventory management system.

This can cause issues when trying to accurately manage inventory and keep track of changes. In a perpetual inventory system, the maintenance of a separate subsidiary ledger showing data about the individual items on hand is essential. However, the company also needs specific information as to the quantity, type, and location of all televisions, cameras, computers, and the like that make up this sum.

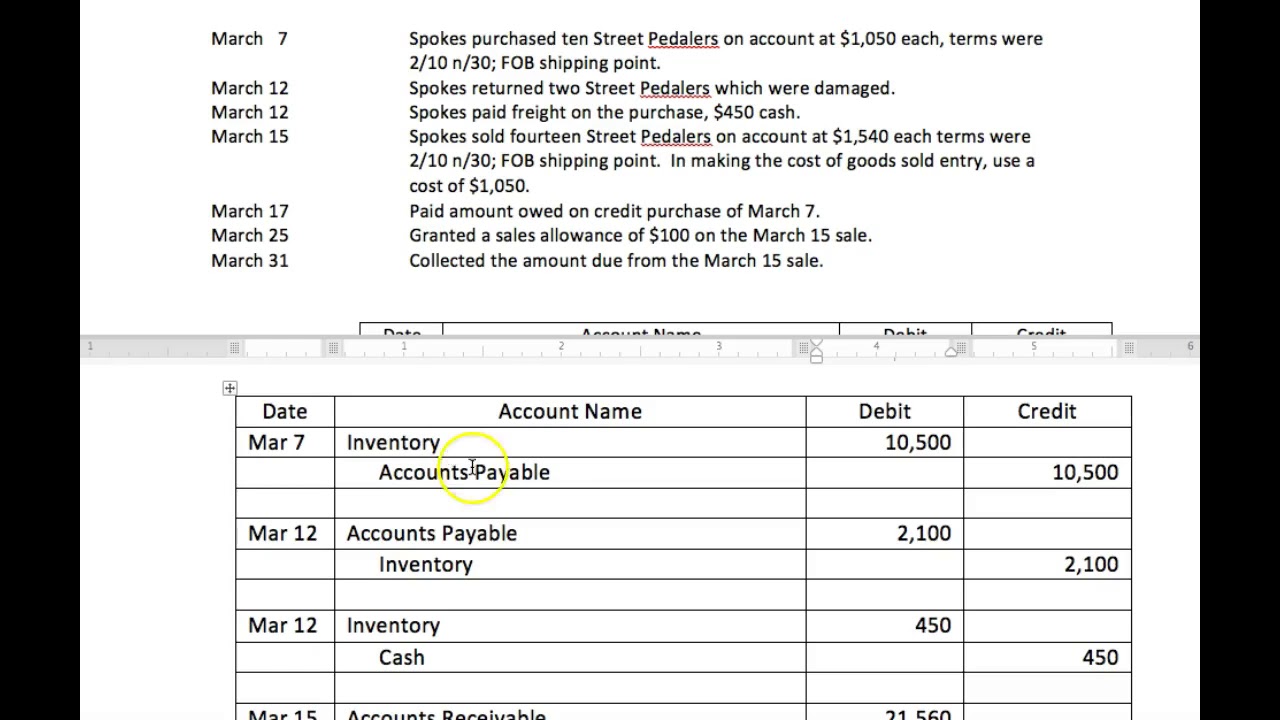

With successive journal entries, all other entries are connected to the accounts for purchases and payables. It enables them to accurately reflect the expenses of the cost of the items offered. A firm finally uses the account to determine final inventory carrying costs. A periodic inventory system updates and records the inventory account at certain, scheduled times at the end of an operating cycle.

Hence, the system is easier to implement, requires little accounting knowledge, and records changes in inventory through very few simple calculations. Sales and expenses for these companies are easily manageable, so they tend to opt for a periodic inventory system, as it’s more cost-effective to implement. Then, you subtract the previously counted ending inventory from the total cost of goods available for sale, to compute the costs of goods sold. That’s why businesses with high sales volume and multiple sales channels use a perpetual inventory system, instead.

You can consider this “recording as you go.” The recognition of each sale or purchase happens immediately upon sale or purchase. The specific identification method is the same in both a periodic system and perpetual system. Although not widely used, this method requires an extremely detailed physical inventory. The company must know the total units of each good and what they paid for each item left at the end of the period. In other words, the company attaches the actual cost to each unit of its products. This is simple when the products are large items, such as cars or luxury technology goods, because the company must give each unit a unique identification number or tag.

So, instead of knowing inventory levels in real time, businesses using the periodic system only get updates when they perform those counts. It’s a straightforward way to manage inventory, but it also means stock numbers are only accurate right after the count is completed. Occasionally businesses will take a physical inventory count to determine if it actually has all items it thinks it has per its accounting records.

Cost flow assumptions are inventory costing methods in a periodic system that businesses use to calculate COGS and ending inventory. Beginning inventory and purchases are the input that accountants use to calculate the cost of goods available for sale. They then apply this figure to whichever cost flow assumption the business chooses to use, whether FIFO, LIFO or the weighted average.